Vehicle depreciation calculator taxes

Guaranteed maximum tax refund. Car Depreciation Calculator.

Section 179 Tax Deduction Vehicles List Bell Ford

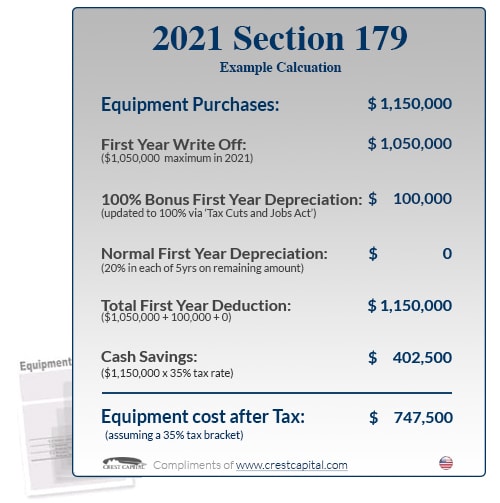

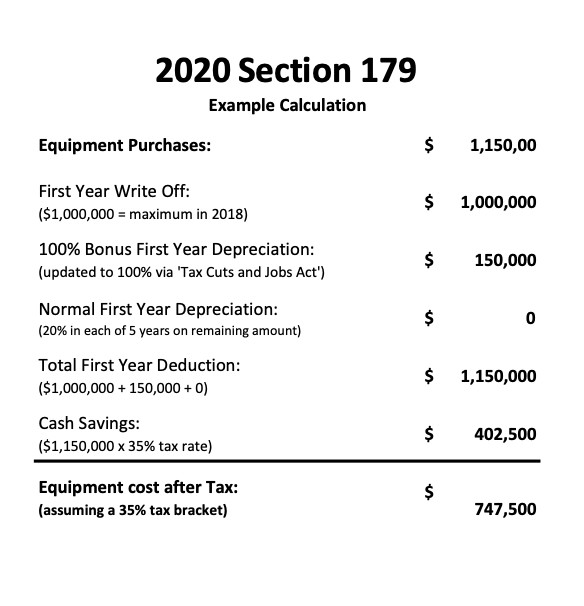

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

. Qualifying businesses may deduct a significant portion up to 1080000 in 2022 to be adjusted for inflation in future years. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The recovery period of property is the number of years over which you recover its cost or other basis.

Consult with your business tax professional before purchasing a business. We have also built historical depreciation curves for over 200 models many of which go back as far as 12. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value Under this method the calculation of depreciation is based on the fixed percentage of its cost.

And Year 6 576. So 11400 5 2280 annually. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life.

R21 40635 x 100 114 R18 77750 30 Sept 201 30 April 202 7 months R18 77750 x 11 x 712 R120489 01 May 202 30 April 203 1 year R18 77750 R120489 R17 57261 x 11 R193299. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

Edmunds data shows a range of depreciation for vehicles between 6 and 45 of MSRP after the first year of ownership. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book. Use this IRC 168 k federal income tax benefit estimator to see what tax benefits your business could potentially qualify for in 2021.

Year 1 20 of the cost. According to the general rule you calculate depreciation over a six-year span as follows. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

Eligible vehicles include cars station wagons and sport utility vehicles. On average though new cars lose 235 of their MSRP after a year. There is a dollar-for-dollar phase out for.

It can be used for the 201314 to 202122 income years. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. The calculator automatically limits the choice of recovery periods to the.

So 11400 5 2280 annually. To calculate the depreciation of your car you can use two different types of formulas. Section 179 deduction dollar limits.

Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. Years 4 and 5 1152. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. Depreciation Calculator Definition Formula For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Calculate your tax refund for free.

Please note that this Section 179 Calculator fully reflects the current Section 179 limits and any and all amendments bonus depreciation. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest. We will even custom tailor the results based upon just a few of your inputs.

It is determined based on the depreciation system GDS or ADS used. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. You can use low medium or high depreciation rates or.

If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above. You can generally figure the amount of. Use a depreciation factor of two when doing calculations for double declining balance depreciation.

Depreciation of most cars based on ATO estimates of useful life is 25 per annum on a diminishing value basis or 125 of the vehicle cost for 8 years. Heres an easy to use calculator that will help you estimate your tax savings. The rules governing depreciation of vehicles can be complex and the tax benefits can vary based on the vehicle you purchase and your business circumstances.

The recovery periods available is determined by the depreciation method selected. Taxis and couriers have higher rates which can also be self-assessed. Discover Helpful Information And Resources On Taxes From AARP.

Bought for R21 40635 incl VAT therefore use the VAT exclusive amount and then calculate the depreciation. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. Ad Premium federal filing is 100 free with no upgrades.

510 Business Use of Car. Free tax calculator for simple and complex returns. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. However if you use the car for both business and personal purposes you may deduct only the cost of its business use.

Car Depreciation Rate And Idv Calculator Mintwise

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Of Vehicles Atotaxrates Info

Car Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Vehicles Atotaxrates Info

Vehicle Depreciation Calculator Online 51 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Irs Publication 946

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

2020 Section 179 Commercial Vehicle Tax Deduction

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator Depreciation Of An Asset Car Property

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax